Asset Allocation for Steady Growth

ASSET ALLOCATION

“Don’t put all your eggs in one Basket” – Anonymous

Asset allocation is an investment strategy to divide investments in various assets, based on investors financial goals, risk tolerance and investment timeline. This has been an age-old wisdom in preserving and growing wealth while managing risk at the same time. Old scripture Talmud suggested 5 millennia ago to divide one’s wealth equally between business, land, and cash. Now we have many more asset classes, but the central principle remains the same. Divide your wealth among various assets. Don’t put all your eggs in one basket.

Modern assets include Equity, Bonds, Real Estate, Precious Metals like Gold, Cash etc. Many new asset classes like Crypto and NFTs are entering the investing world. Characteristics of each asset class are different from each other. Some may provide good returns but are very volatile, some may be illiquid but provide steady income. It’s important to understand the nature of each asset and marry it with individual goals and risk tolerance to arrive at an asset allocation plan.

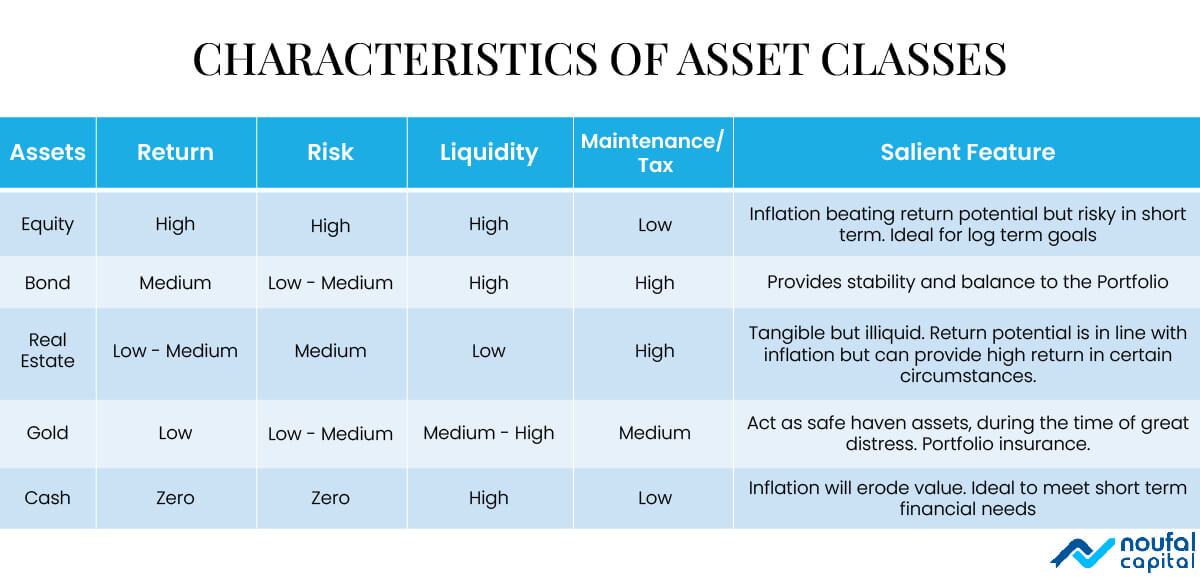

Characteristics of Different Asset Classes

Different investable assets do have different characteristics. This table summarizes some of them.

As you can see, characteristics of each asset can vary widely. If you have a safe job and are young, it makes sense to invest a large portion of your assets in equity. If you are retired, bonds may form most of your assets. If a person can’t handle the volatility of the stock market, real estate may be the right choice for him. Does that mean one can be in 100% either in equity or 100% in real estate? Answer is a resounding No. Its too risky to bet on one asset alone with your entire investment as it will be too risky, as is apparent from next section.

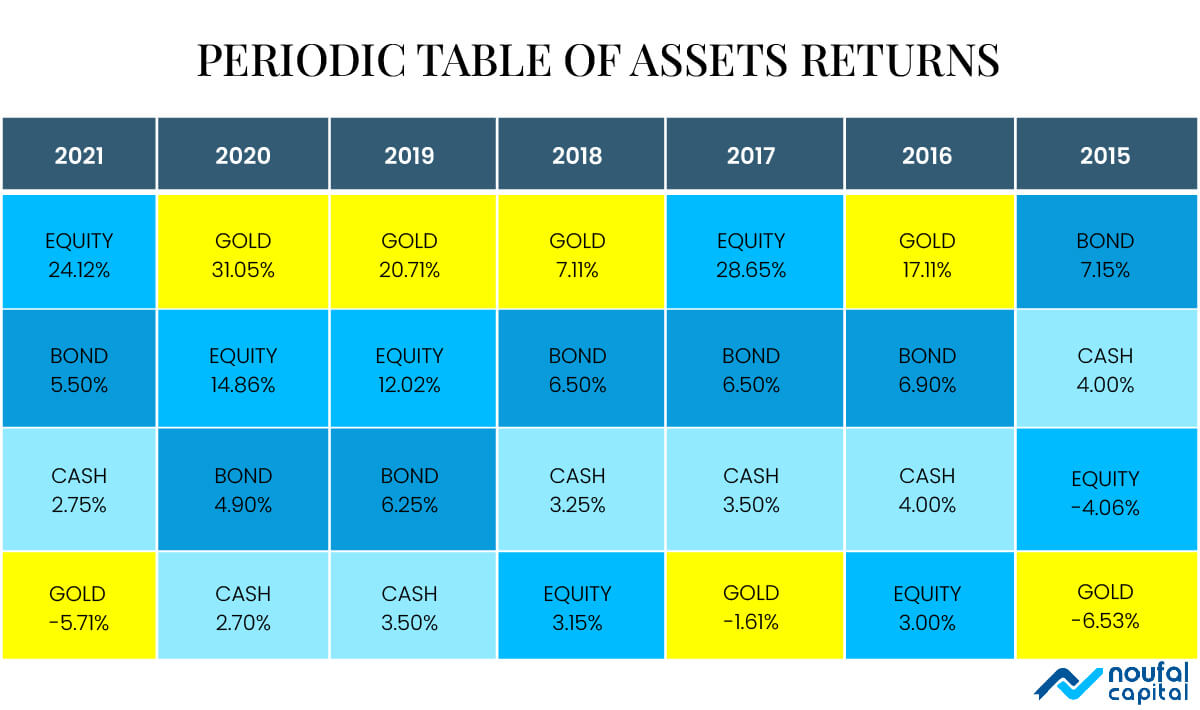

Periodic Table of Asset’s Returns

Variability of returns for an asset class is readily apparent from the table shown below. This table visually depicts returns of assets for each year, ranked from highest to lowest.

Real estate is omitted because of lack of reliable data. But all other major assets are included. Equity is represented by the NIFTY index. Bond by FD rates and Cash by savings bank rates. This table is instructive in conveying the importance of asset allocation. Any assets, however good they are, will undergo a bad period of poor returns. It’s the uncertainty of the future that’s causing this and no amount of advanced research can anticipate such results. This clearly demonstrates why we can’t be in one 100% in one asset. We need multiple assets as part of a portfolio such a way when one sags, another sig!

How to determine Asset proportions?

Now we showed the virtue of spreading our wealth in various assets, how to determine proportions in each of them? Do we go Talmud way and spread it equally? It’s one way but there are several other established practices as well. Within assets, the Equity-Bond proportion is particularly significant. 60%-40% ratio of Equity to Bond is one of the popular asset distributions. It balances the growth potential of equity with stability of bonds.

Age based asset plan is another way. In this method, allocation of bonds is in direct proportion to one’s age. If investor is 40 years old, bond portion is 40% and equity at remaining 60%. This method takes into consideration the fact that as we age, our ability to take risk diminishes. Several target date retirement funds use this method.

The other assets proportions are highly dependent on individual situations, financial goals, risk tolerance etc. A cash reserve of at least 6 months expense is must as an emergency fund. A 5-10% gold allocation is found to provide some protection during catastrophic events that can affect other assets badly. Then we all have our real estate holding we acquired and inherited. Assets to which we emotionally connected and would like to pass on as our legacy. There is no simple formula for deciding on asset allocation. It can vary over time for an investor also. Careful analysis of an individual’s goals, risk tolerance and other factors play into crafting an optimal plan.

SUMMARY

Allocation of investment into multiple assets is critically important for preserving wealth. It’s considered that asset allocation is one of the most important decisions that investors make. Selection of individual securities is secondary to the way that assets are allocated in stocks, bonds, and cash and equivalents, which will predominantly ultimately determine success of your investment. There is no one-fit-for-all method that can find the right asset allocation for every individual. Various methods and guidelines are available. Decide based on careful analysis of one’s financial goals, risk tolerance and other factors.

Happy Investing!