Power of Compounding

POWER OF COMPOUNDING

“Compound Interest is the 8th wonder of the world. He who understands it, earns it. He who doesn’t, pays it” – A Einstein

Long ago, there was a king, who ruled a wealthy and prosperous kingdom. He liked the game of chess, and he would invite many to play with him. One day, a wise man from a distant land visited his kingdom. King naturally challenged him for a match in chess, which the visitor accepted. King was very good at chess but to his surprise was beaten by this sagacious looking visitor. King, impressed by the skill of his challenger, offered a reward of his choosing. Sage spread the chess board in front of the king and replied. “Oh King, I am a man of simple means. All I need is some grains. You can give one grain in the first square and double it on the next square, through all the squares of this chess board. King was amused by this simple but unusual request and readily accepted, without much thought.

Now think about this request. One grain in the first square of the chess board, 2 grains in the second square, 4 in third and 8th in fourth square. By the time, first row is done, you need a total of 255 grains. By the end of the second row (16 squares), the total becomes a tidy 63,437! On the twentieth square alone, the king would have to put out 1 million grains and a mammoth 1 trillion grains on the 40th. King suddenly realized that even all granaries in this entire country will not be enough to fulfill sage’s request.

What started as small exploded dramatically into big numbers by doubling in each step. This demonstrated the power of compounding.

In the chess example, grains were doubling every square. But in money terms, imagine your money doubles every 5 years. It will quadruple in 10 years. 16 times in 20 years! This is the magic of compounding! It does wonders to wealth creation, reinvesting your gains back into investment, resulting in growing wealth at a much faster pace.

Compounding in Investment

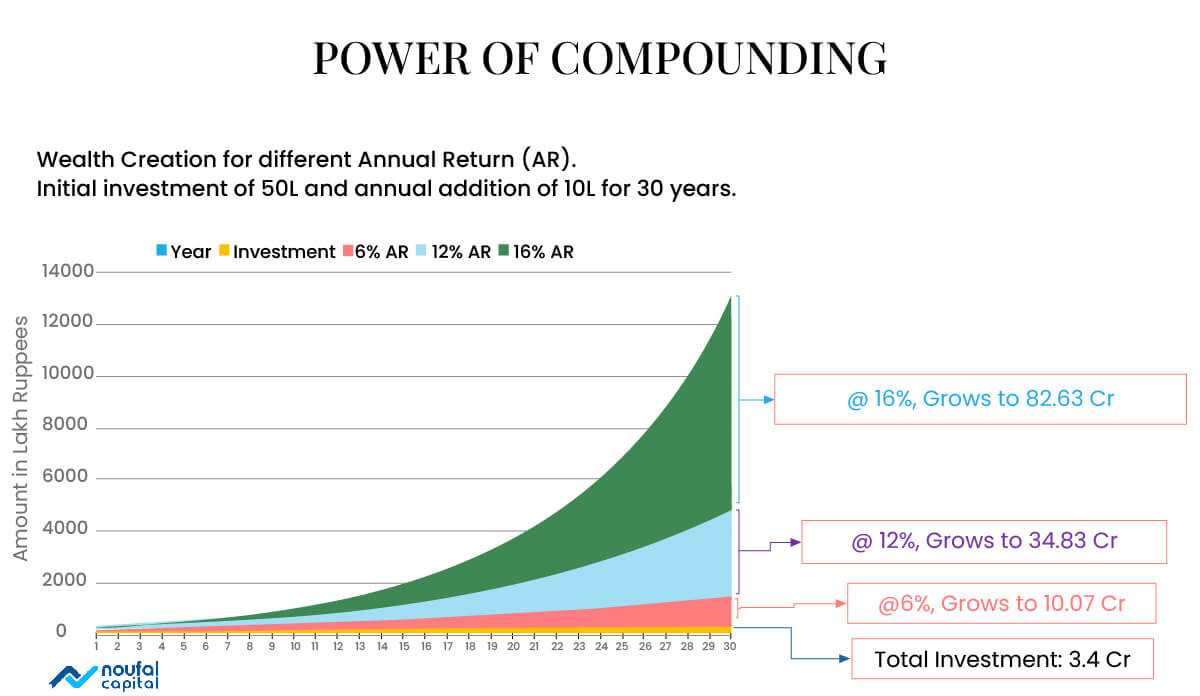

Imagine a real-life scenario now. Consider a typical investor. Someone who started with ₹10 Lakh as initial investment and then added ₹1 Lakh / year for the next thirty years. Now he can invest in various assets. Investment returns are expressed in annual returns. It’s the percentage growth you may expect on average in a year. Bank Fixed Deposit (FD) could give returns of the range of 6%. A mix of equity and bond could give a return higher return – say about 10%. He can also for some high-risk equity investments which could result in much higher rate of return. Graph below shows how wealth gets grown under various return scenarios. Each co9lured area represent amount of money accumulated.

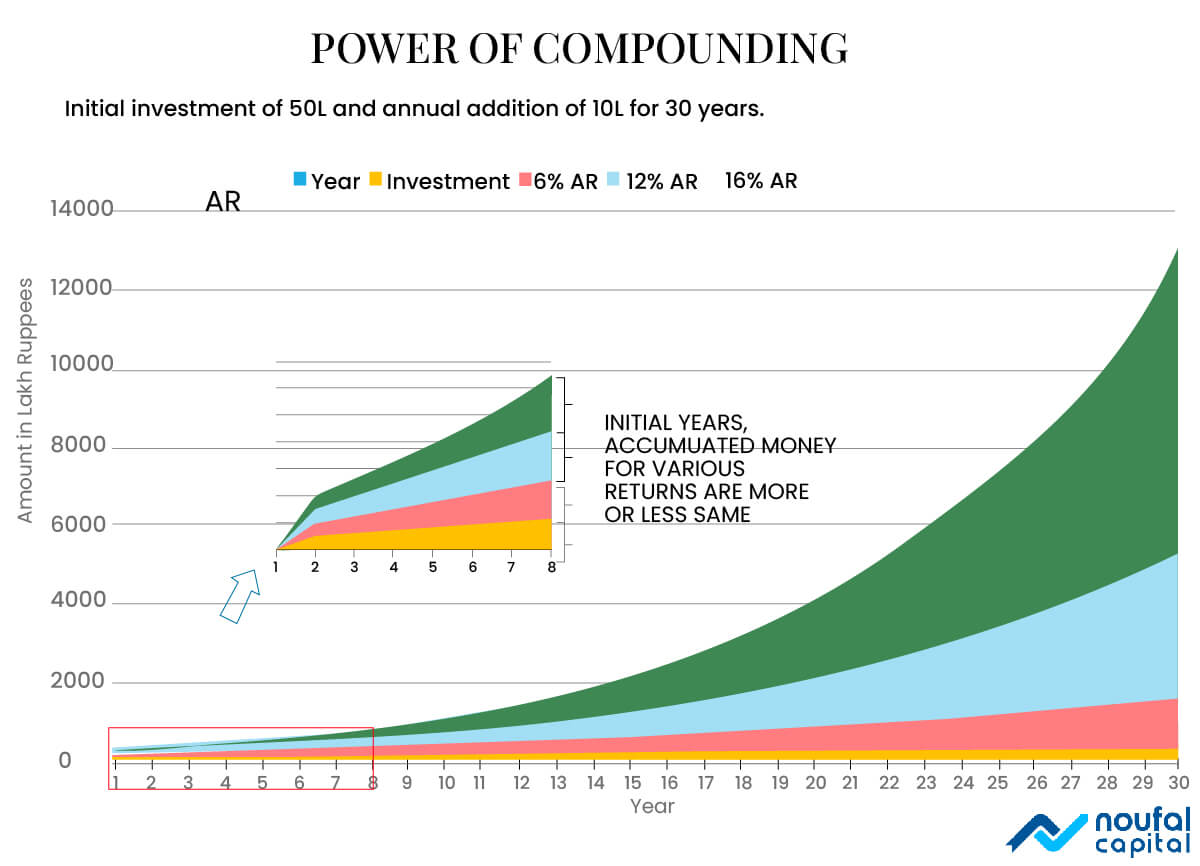

Look at how dramatically wealth gets accumulated over a period due to compounding. Also, the impact of higher annual rate of return, which makes a huge difference in accumulated corpus at the end of investment period. If you are mathematically inclined, you can appreciate this statement: if return increments in arithmetic progression, wealth accumulates in geometric progression.

Also notice that the difference in accumulated wealth is not noticeable in the initial few years. It’s after a while, the effect of compounding is apparent.

SUMMARY

Compounding is a powerful method for wealth creation. It’s due to accelerated accumulation of wealth due to reinvestment of gains. Two important factors decide the success of compounding. First is the period of investment – longer the better. Second is rate of return, higher the better. In summary, the secret of wealth creation boils down to patient investment with long term focus in high return assets.

Happy Investing!