Life Insurance – Care for Loved Ones

“A man who dies without adequate life insurance should have to come back and see the mess he created” – Will Rogers

Imagine you are the sole bread winner of the family, and something happened to you. How do you think your family will survive? If you haven’t thought it, it’s time to do so. If there is one certainty in this world, its death and it can wreak havoc in the lives of our loved ones. Little bit of prudent planning can mitigate some effect of it – the financial uncertainty of losing main earner. It’s called Life Insurance.

Life insurance is about protecting your loved ones from the financial mess if you the breadwinner dies prematurely. It’s about caring for them. Its moral responsibility of an individual to carry enough life insurance if others are dependent on her/him. Conversely, if you don’t have any dependence, then no need to have life insurance either.

Term Insurance

First mistake people make is not having insurance. Second one is not having adequate insurance. If you add up all the “sum assured” values from your insurance policies, most likely that it’s a small value, no way representing your life worth. Sum assured (death benefit) is the amount beneficiaries receive in the event of death of the policy holder. It must be adequate for its intended purpose – mitigating the loss of income.

Main reason for the low death benefit is the type of insurance you carry, more correctly the type of insurance certain sales agents and insurance companies push. They are a mixture of savings and insurance. Such policies neither help with savings (most of them yielding around savings banks) nor with insurance -totally inadequate insurance coverage. They come with high premiums to cover for commissions and fees. Unfortunately, only parties enriched from such policies are insurance companies and their sales agents. Do not fall prey to such policies. Never mix insurance with investment.

Insurance is for protection against financial impact if the income earner in a family dies. Term insurance is the ideal solution for this. Premium you pay is the fee the insurance companies charge for covering the risk. It covers risk alone and not used for investment fees or commissions. Therefore, premium will be very less and adequate coverage can be obtained at reasonable rate. A coverage of ₹1 Core is possible with a premium of ₹15,000/year for a healthy 35-year-old. As the name indicate it gives protection for certain term of your choosing – say 25 or 30 years

How much Insurance?

As you realized by now, one critical factor is ensuring enough coverage is taken in your life insurance. But how much is needed?

Life insurance is to mitigate the effect of loss of revenue, in the event of death of an earning member. Therefore, the benefit should commensurate with the life worth of the insured. There are various ways to calculate this amount. Income replacement method calculates this amount by multiplying one’s income with the number of years. The expense replacement methods adds up where all potential expenses to arrive at thus number – regular expenses, loans, mortgages, kids’ education etc. Many times, such calculations will yield large sums and the premium will be too much to bear.

However, following the thumb rule seems to work well in most of the situations.

Life Insurance Coverage needed = 10 times Annual Gross Salary – Total Assets + Total Liabilities

For example, if the annual gross salary is ₹10 Lakh. Assets are worth ₹50 Lakh and loan of ₹20 Lakh, Insurance coverage needed would be about ₹70 lakhs (=10*10 – 50 +20).

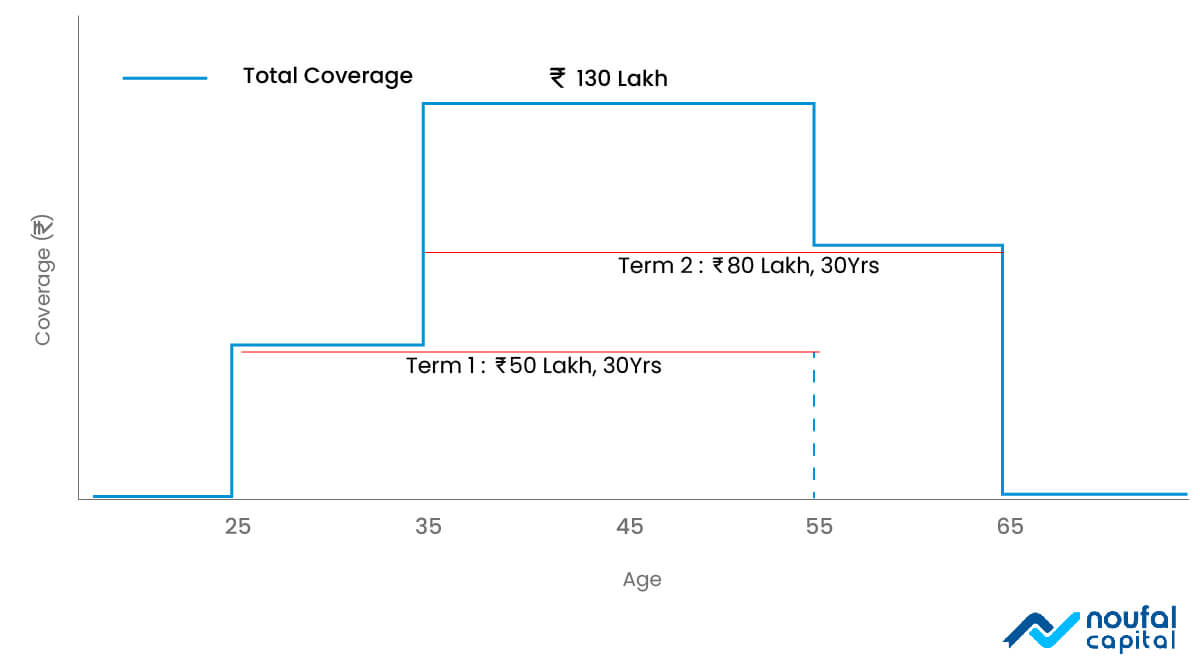

Amount to be covered may change as the policy holder’s life situation changes. Salary may increase, loans may be repaid, new family members etc. In the beginning of the career, income may be less, so the need for insurance is less. Towards the later part, you may have accumulated certain assets so need for coverage is again less. Peak insurance is needed in the middle – between age 35 – 55. So, it’s essential to review periodically to ensure that coverage is adequate and apt all the time. Seek the help of a trusted advisor if needed.

An example is shown above. Here, two term plans are used for the entire working life (25 – 65). One bought in early and another one later. See how peak coverage aligns in the middle when it’s most required. Term insurance provides such flexibility in adding or removing coverages based on life needs.

Many employers provide life insurance to their employees. While this is admirable, it’s important to note that this insurance gets terminated the moment an employee leaves the job. So, it’s not advisable to count only on employer provided life insurance.

Other factors to consider

We now have some idea on how much and how long. Let us consider a few other important points while choosing an insurance plan.

- Insurance company: Insurance is a well-regulated industry and term insurance has become a commodity product. So, choice of insurance company is less critical nowadays. However, choose one among the top 10 companies with good customer service and claim settlement ratio.

- Riders: Many policies come with different riders – accident claim, Critical illness, return of premium etc. Most of them are not worth the extra premium they charge. Be very critical of them and buy only if you feel they suit your needs.

- Do not conceal on insurance application: Insurers collect a lot of critical information about your age, health, habits (smoker etc.) and other details during initial assessment. Few of them may even insist on medical tests. They use this data to underwrite the risk of insurance. Do not furnish incorrect data. Follow all procedures correctly. If they find any misrepresentation, there may be delay, or worse, deny disbursing benefits to your family. This will only multiply the misfortune of the loved one, in the worst possible time.

- Revise and review nominees: Nominees are those who get death benefits. It can be a spouse, kids, parents, or someone else. Life situations can change and so are the nominees. Ensure that nominee information is all insurance policies are revised and revised periodically to reflect the will of the insurer.

Happy Investing!