Equity Investment for Wealth Creation

EQUITY INVESTMENT

“Risk comes from not knowing what you are doing” – Buffet

You would have heard a lot of comments like “Stock Market is gambling. Stay away! “, “Equity Investment is too risky”. “Mr. Jones lost his entire wealth in the last market crash” over the years. You yourself may be a little apprehensive about investing in equity after hearing all these, unsolicited advice, and comments. None of this is true. Stock Market is one of the widely accessible wealth creation avenues for common people. This article is an attempt to shed light on Equity (Stock) investment and how to do it properly.

Equity Investment: Excellent return but volatile

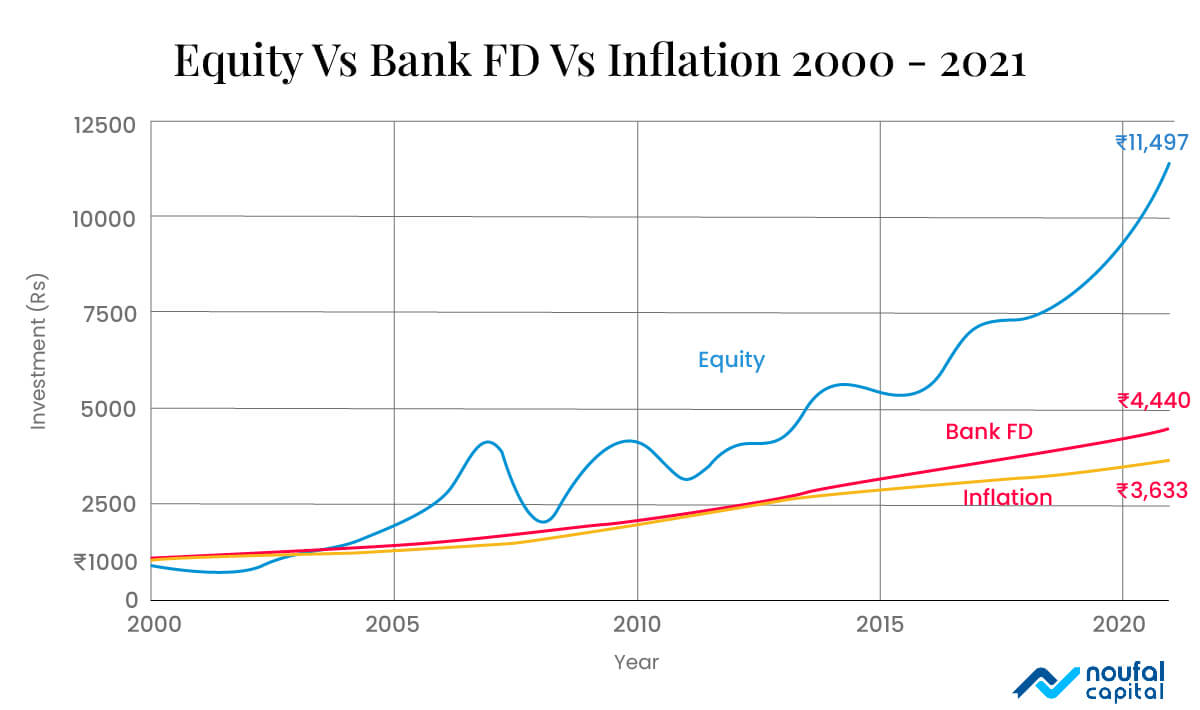

Consider two investors, Beena and Evan. In the year 2000, Beena invested ₹1000 in safe bank FD, whereas Evan invested the same amount in Indian equity. They forgot about it and 21 years passed. Then they both checked their investment. Beena made a tidy sum of ₹4440, whereas Evan to his surprise found his investment ballooned to ₹11,497! You may see how each of their investment fared during this long period of two decades plus.

As its clear from this example, equity investment could give very good returns compared to other investment options. Both equity and bank FD beat inflation (yellow line in figure) but band FD beat inflation just barely. Equity beat inflation very comfortably and produced a handsome return to the investor. This is a very important characteristic of equity investment. It could reliably beat inflation.

Also notice the zig zag nature of the equity investment (blue line). Highly volatile. While bank FD is growing steady, equity investment is going up and down. In fact, it dipped below ₹1000, originally invested, right at the beginning itself, but recovered a few years later.

Around 2008, equity investment again suffered a wild swing. This was due to the market crash during the global credit crisis. In a matter of a few months, investors lost 50% of their value! But eventually this also recovered and went on to new highs.

This is one of the characteristics of equity investing. Growth is never on a straight line. There will be ups and down along the way, few big, many minor. Equity investment is inherently volatile.

What is Equity?

So, what exactly is equity? How does equity produce such a high return? Let us dig a little deeper.

Best way to understand equity is in terms of ownership. When you have an equity in a firm, it means you have part ownership stakes in that firm. If such firms are public, equity of them are available for the public to purchase. Such equity is commonly known as Stock of the company, and they are traded in stock markets. Generally, equity and stock are synonymous.

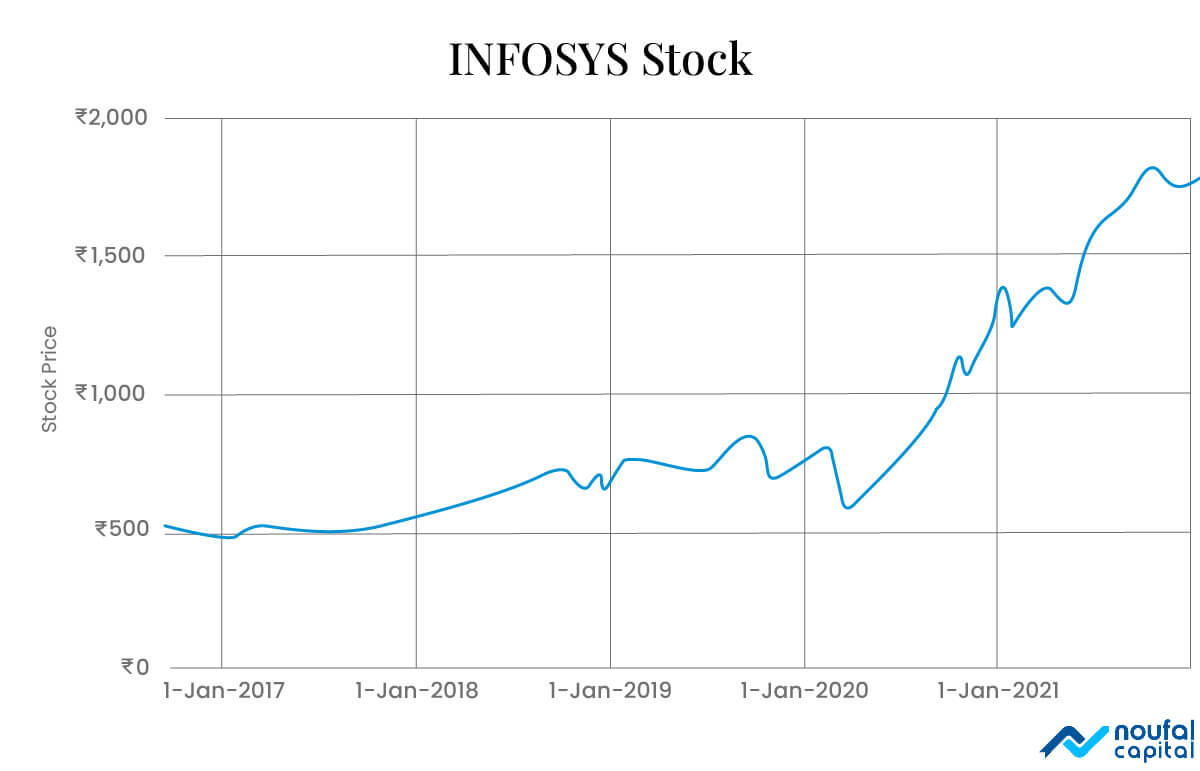

Let us take an example of IT giant, INFOSYS. INFOSYS is a public listed company with 426 Crore outstanding shares. If an investor buys a few shares of INFOSYS, he/she is acquiring part ownership of the company. If it is 1000 shares, his/her proportionate ownership would be about 0.00234% (1000 / 426 Crore). He/She is now officially a shareholder of the company and has certain rights on company matters. As a part owner, he is also eligible for a share of profits the company makes, in proportion to his ownership. This is called dividend. However, the main reason someone buys a company stock is in expectation of price appreciation. INFOSYS share price has appreciated from ₹500 to ₹1,788 in the last 5 plus years. That’s an annual growth rate of 26%.

During the same period, they issued a dividend of ₹277 per share. They also bought back a part of shares held by the public at a higher price (in effect handing out more money back in the hands of investors). Adding the price appreciation and dividend, annual return from holding INFOSYS shares in this period were more than 27%! This is an astounding rate of return. Reason for such good apperception is, increasing profits the company has generated over this period. Higher profit will increase the enterprise value of the company and it will be reflected in stock price. In other words, stock price appreciation will be directly correlated to profit, which is nothing but return on capital. Therefore, stock investments are expected to give higher return than risk free options like bank FD. If otherwise, everyone will invest in Bank FD and not in profit generating businesses.

[please note that INFOSYS is chosen merely as an example. Do not construe this as endorsement of it for any investment]

Stock price of a company reflects its future profit generation potential. Several factors would have contributed for this increase in profits. A good equity investor should be able to anticipate such factors and identify profit generating companies for investment. It’s not an easy job. Many companies fail to generate adequate profits or even run into losses. Their stock price can go down causing severe losses to investors.

How to invest in Equities?

As described in the previous section, the stock price of a company depends on its future profit potential. In other words, investors should pick companies, which can grow profits each year well into the future. This is easier said than done. To decide if a particular stock is investment worthy, detailed analysis is to be done on various dimensions of the company. Company financial performance, its unique capabilities compared to competition, quality of the management, industry direction, regulatory environment etc. are few of them.

Also, current market price does have an outsized impact on expected returns. If stock is already priced high, it may not appreciate much, thus dampening future returns. Therefore, current price (valuation) is another important factor to consider.

It’s not easy for everyone to perform these tasks and select stocks for investing. It takes time, right experience, and a certain aptitude to perform this due diligence. It’s better to seek help from professional investment advisors, if needed.

Mutual funds is one route for equity investments. They are portfolios of stocks, managed by professional money managers, which individual investors can buy into. It’s less risky than buying stocks directly. But there is a fee, which can eat into returns. Also, there are thousands of mutual funds in the market. So, selection of the right ones itself would need some due diligence.

Index funds/ETF addresses these problems. They simply replicate the entire market and hence such funds/ETF give returns in line with the market. Costs are very low and hence such funds are one option to get exposure to equity investing. These are perfect for novice investors to begin with.

What about risk?

Risk in equity investment is defined as permanent loss of capital. As you have seen in previous sections, stock prices are inherently volatile. This is due to the nature of a business where future profit can be affected by unforeseen events and stock prices will adjust to reflect it. It could be a pandemic like Covid, a regulatory change affecting the whole industry, or some fraud took place in the company. This can result in stock prices tumbling down. One of the ways to manage such risk is investing in multiple companies of varied industries, simultaneously. Form a portfolio of stocks instead of just one or two. This concept is called diversification. Chances of entire stocks in a portfolio going down at same time is very less and hence risk is reduced to a large extent. Benefit of diversification in managing risk is studied widely and well understood. Modern portfolio theory, a robust academic theory on investing details the systematic procedure of diversification to minimize risk.

In the short term, stock prices behave like a voting machine and in the long, they are like a weighing machine. Short term price reflects emotions and sentiments of thousands of market participants. However, over a long period, prices track the company’s fundamentals. Thus, a long-term focus is critically important for equity investment. Patience and temperament are two qualities successful investors cultivate, to tide over difficult times during this long haul in the market. Don’t make notional loss permanent by selling in the worst time. If stock is good, chances are that it will recover.

Rules to Follow

- A plan and disciplined execution: It’s important to have clarity with your financial goals, short and long term. Have a plan on savings and investment towards achieving these goals. Then a disciplined execution to follow through this plan.

- Monitor the investment: Equity investment would need routine tracking and monitoring. Even after exhaustive research and analysis, market conditions can change, companies can falter, the economy can deteriorate. It’s therefore critical to manage such risks by taking needed action in a timely fashion on your investments.

- Do not follow “Tips”: This is a mistake many novice investors fall prey for. Acting on ‘hot tips ‘from friends and following others in buying and selling stocks. This is a sure way of losing money. Nothing can replace doing your own research and analysis while making investments. If this is not your forte, seek the help of a trusted investment professional.

- Diversify: Don’t put all your eggs in one basket. Diversification helps to mitigate huge portions of risks, without compromising too much return.

- Long-term focus: It’s enticing to make a quick buck on short term trades, but they almost always end up in losses. Focus on the long term to grow the wealth by leveraging the power of compounding over a long period.

SUMMARY

Short of owning a successful business, equity investing is the most accessible way for common people to create wealth. It routinely performs well above other asset classes and beats inflation consistently. Equity investment is riskier. However, Diversification and long-term focus can mitigate a large part of such risks. Careful analysis to be done while investing in equities. Seek professional help to guide you on choosing the right equity instruments, if needed.

Its apt to say that while investing in equity may be risky, but not investing is riskier, as your wealth will erode over time due to inflation. So don’t hesitate and secure a better financial future through equity investment.

Happy Investing!