Fixed Income Investing for Wealth Preservation

FIXED INCOME INVESTING

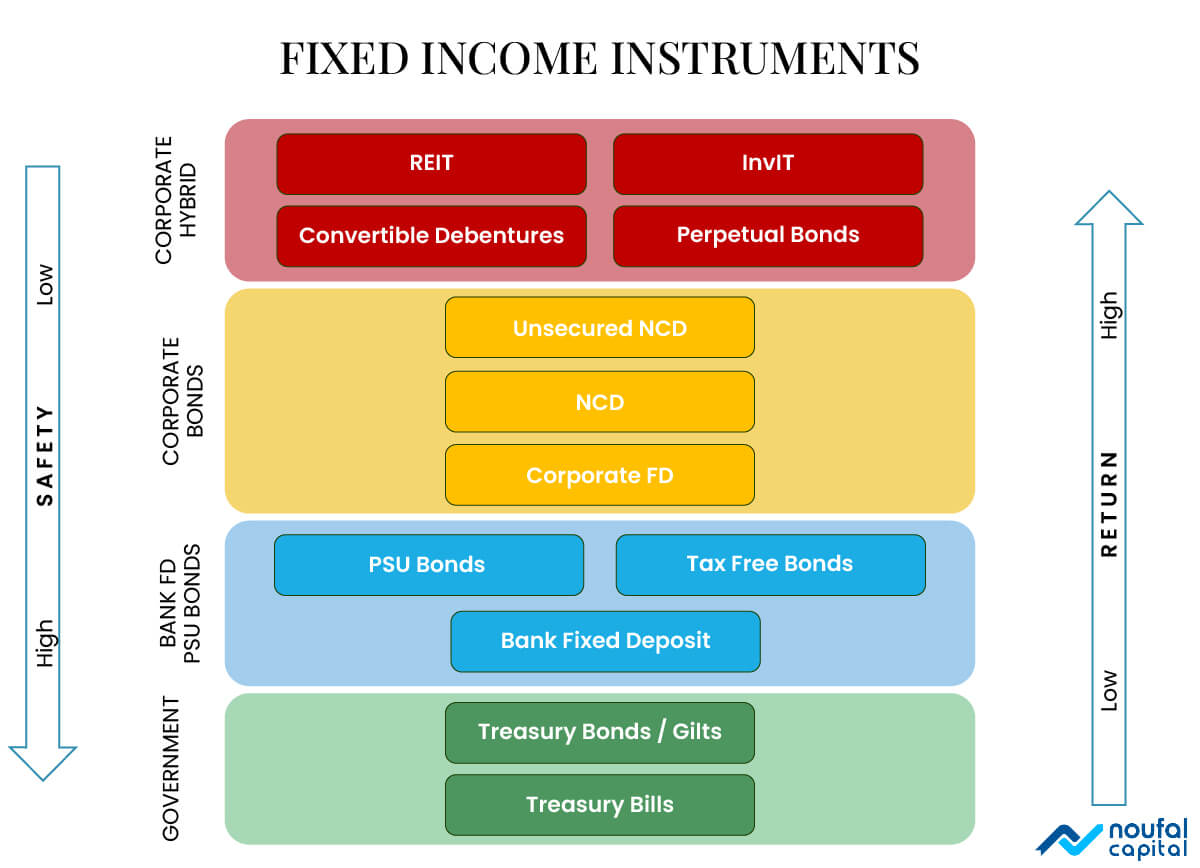

Fixed Income (FI) instruments are interest bearing investments. Bank Fixed Deposit (FD) is the most common example. There are many others like Government treasury bonds, corporate bonds, Corporate FD, Tax free bonds etc. Fixed Income instruments pay periodic interests (coupons) to its investors. Therefore, they are suited for regular income on a periodic basis. If interests are reinvested, they can provide long term safe and steady returns as well.

Fixed Income instruments are also known as bonds or debt. They form a much huge portion of the financial investment world, larger than equity. They are also easily accessible and easy to understand. They should form an integral part of an individual’s portfolio.

Investing in Fixed Income Instruments

Most common FI instrument is Bank FD. Investors can put money in a bank FD with a stipulated term (7 days to 10 years) with notified interest rate. Bank will pay periodic interests and principal at the end of the term. In general, FI instruments are issued by various agencies to meet their funding needs. That’s why they are also called debts. It may be the central government trying to bridge the budget deficit, or banks collecting funds for their lending business. It could even be corporate for their capital expenditure needs. These debts can be bought by an investor and the issuer will pay agreed upon interest periodically and principal at the end of the term.

FI investment is less risky than equity investment. Issuer is legally obligated to pay the interest and payback principal, as per agreed terms. Many bonds are secured with assets of the issuer and thus provide additional protection. Safety of a bond is derived from credit worthiness of the issuer to make interest payment and return of principal. Governments don’t default on such payments and thus Govt issued binds (treasury bonds) are considered the safest. Safety of corporate bonds are generally less compared to government bonds or bank FD. Within corporate bonds, safety will depend on credit worthiness of the issuer. There are rating agencies who evaluate and rate such corporate bonds so investors can make a judgment before investing. For example, AAA and AA rated bonds are very safe compared to say BBB or BB rated.

Now, how does a company whose bonds, which are rated less safe than Government bonds or Bank FD attract investors? By providing attractive interest rates, thus boosting potential returns. Therefore, there is an inverse relationship between safety and returns in bond investments. This is generally true in all investments. If investor seek higher return, he/she must bear additional risk. There is no free lunch!

There are some exotic varieties like Convertible bonds (bonds convertible to equity), Perpetual bonds (Bonds without any end date). They also pay interest like other bonds but do have these special characteristics. REITs and InvITs are another kind of instruments, who pay interests/dividends like bonds. But they are investments specifically made for real estate or infrastructure projects. It’s advisable to take help of a financial advisor to evaluate what is suitable for your specific situation.

Bonds Funds/ETFs: As seen above, there are different kinds of bonds available. Not only are issuers different, but the terms of the bond (interest rate, duration etc.) also can also vary. Bond funds (or ETF) are collections of multiple bonds put together and transacted together. Investors can buy or sell units of this fund/ETF. This provides greater diversifications and certain tax benefits in comparison to buying individual bonds. Employee Provident Fund (EPF) is a fine example of such a collection. They invest in highly rated AAA/AA bonds of various issuers. There are several debt mutual funds and ETFs also available in the market.

Taxation: Fixed Income instruments are taxed heavily. Gains (Interests earned) are taxed at the marginal tax bracket of the investor, and it can be high.

Fixed Income securities are listed in the secondary market; they can be bought and sold at a different price. This can trigger capital gain tax. Short term capital gain tax is high marginal tax bracket rate. Long-term capital gain tax can be as high as 20%. They are taxed higher than equity investments. Moreover, long term capital gain kicks in only after 3 years, unlike 1 year for equity. All these taxes are real drag on return. After factoring taxes, there is a chance that returns from fixed income are not covering inflation.

Due to these reasons, tax advantaged accounts are best suited for holding FI instruments. Employee Provident Fund (EPF) and National Pension Scheme are two such accounts, where interests and capital gains are not taxed. This can make a big difference in returns. In fact, EPF is the best place for fixed Income investment available. It provides better interest rates (compared to Bank FD) and interest and principal grow tax free. Therefore, utilize such accounts to the maximum extent.

In the event, there is no room in such accounts, bond funds can be considered. Almost always, Bank FD is a poor choice given paltry interest rates, high taxes, and low duration.

For high tax bracket investors, tax free bonds are also an option.

Are they completely safe?

Suppose you bought a 10-year bond from ABC corporation, which pays 10% coupon (interest) payable every year. Unfortunately, business went bad, and they filed for bankruptcy after 5 years. They no longer can make remaining coupon payments or return the principal. This is called defaulting on bonds. This is a risk, when the issuer of bonds become insolvent and unable to honor terms of issued bonds. A bankruptcy court will decide and distribute whatever assets remaining among all bond holders. You could get paisas to rupee or nothing at all, based on whether the bond was secured or unsecured.

Default risk is rare in the case of Bank FD or Public Sector Unit (PSU) debts. Treasury bonds (Government debt) don’t default at all. However, corporates could fail and default on their bond obligations. Therefore, its critically important to buy bonds only from top rated (AAA or AA) issuers.

As mentioned, Treasury bods don’t default, but they face another kind of issue.

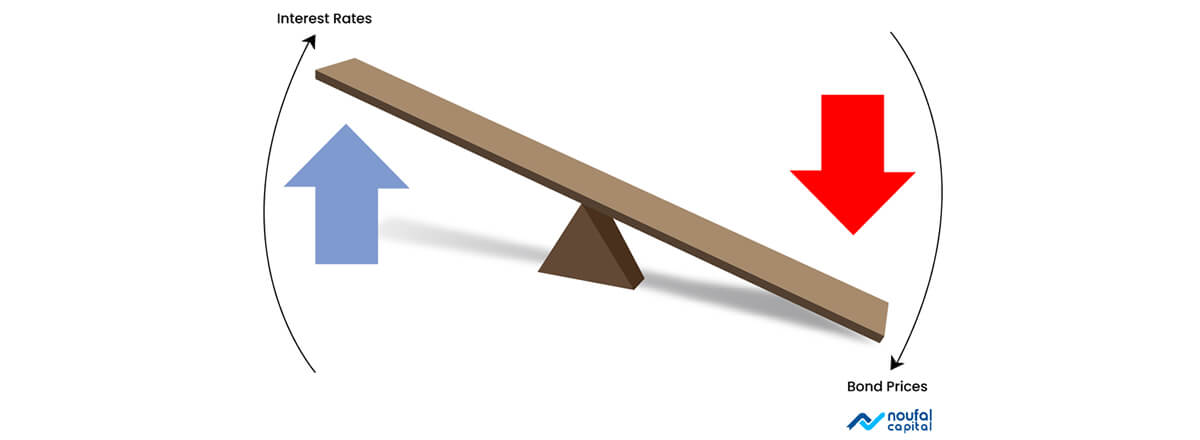

Consider a 30-year government bond with a face value of ₹1000 at coupon rate of 6%. Suppose after the initial issue, this bond is listed in the market, where investors can buy or sell. Market price of the bond will differ from the original issue price (face value of ₹1000) based on the prevailing interest rate. If the prevailing interest rate is 5% (less than coupon rate of the bond; 6%), then the bond price will be higher than face value. Conversely, if the interest rate is higher, say 7%, the price of the bond will go lower. This is called interest rate risk. Value of your bonds will go down when the interest rate goes up.

Quantum of this price variation will depend on two factors: Difference between coupon rate and prevailing interest rate and the time remaining until maturity (duration). There were instances where bond prices crashed over ten percent. However, it’s not an issue if you hold the bond until maturity; the issuer will pay back full-face value. Therefore, the way to address this risk is to match the duration of the bond with the investment horizon you have. That way, you can avoid forced selling in the market at a lower price. A good investment manager can help decide the right duration bonds for you.

Duration offered by Bank FDs are limited. Suppose you invested in a Bank FD offering 5% interest. After maturity, you may have re-invest in another FD with a rate that is less than the old one. This is called reinvestment risk. If your investment horizon is longer (more than 10 years), this could be a real problem. Solution is to buy long term bonds to lock in a good interest rate for a long time. Nowadays even 40-year long government bonds are available. If money is needed any time, it can be sold in the secondary market.

Safety: preservation of capital, is the most important factor while investing in fixed income. Returns are only secondary. If you chase returns in fixed income, one of these risks could show up and you could lose money. Avoid return chasing.

Why invest in Fixed Income?

Now you know FI returns are less, they are heavily taxed and could face some risks as well. Then why would someone invest in them?

Main reason is safety. Fixed income investing is for preservation of wealth. If you have financial needs coming up in the short term, the best way to preserve money is investing in fixed income assets. Not in equity or any other assets. Fixed income assets are safer and liquid and are ideal for protecting wealth for the short term.

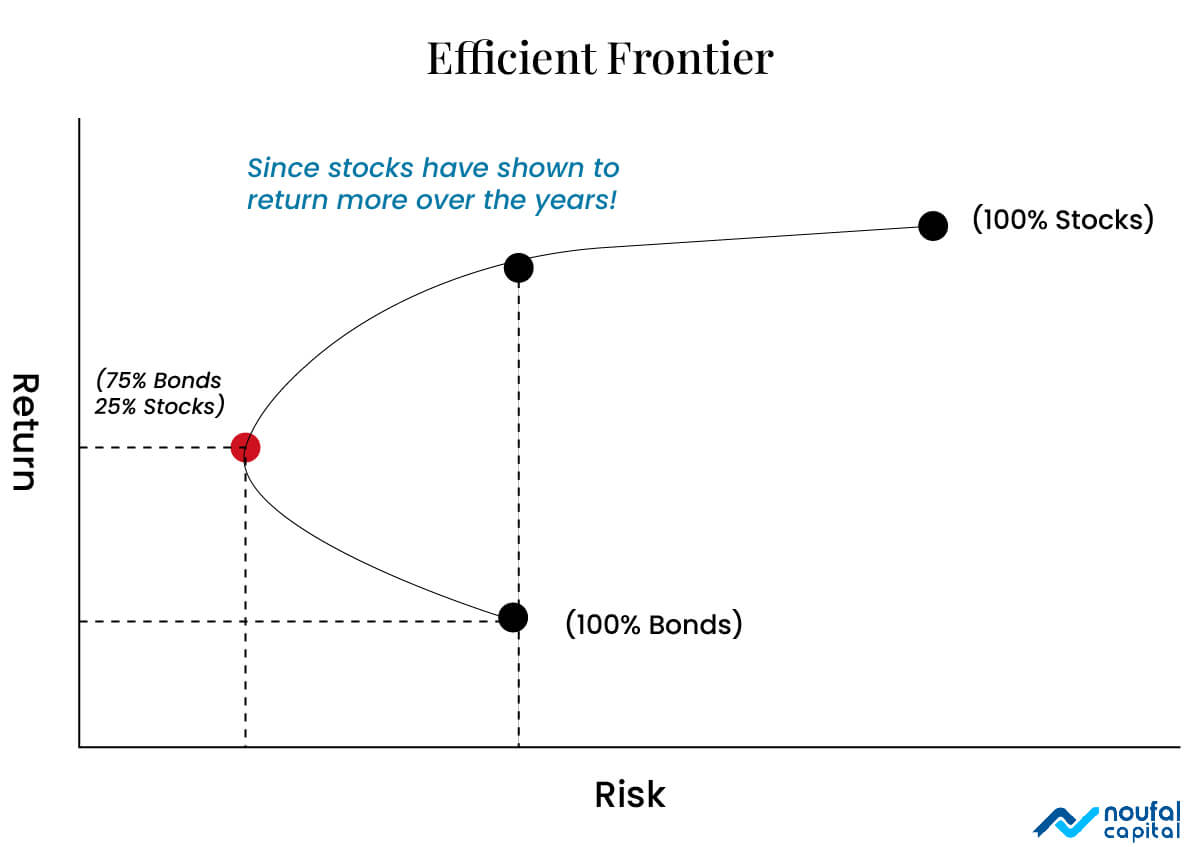

It’s not just that. In one of the seminal academic works in investing, American economist, Dr Markowitz has shown that adding a bit of bonds into a portfolio of stock will drastically reduce the risk of the entire portfolio, without sacrificing returns too much. This remarkable theory is the cornerstone of Modern Portfolio Theory (MPT).

Above picture shows the effect of combining bonds with stocks in reducing risk. Pure stock risks could potentially give higher return, but risks are also much higher. 100% bond portfolio offer less return for same risk. An optimal combination of stock and bond can minimize risk while achieving optimal return. Using MPT, it’s possible to build an optimal portfolio of stocks and bonds to minimize risk for an optimal return. Example shown, its 75% stock, 25% bonds. However, this could vary based on attributes of stocks and bonds. Details are beyond this article’s scope, but this theory reiterates the importance of bonds in an investor’s portfolio.

SUMMARY

Investing in fixed income (bonds) provides stability to the portfolio. Its well-known fact that mixing them along with equity will dampen the overall volatility and thus reduce risk of the portfolio, without sacrificing return. Safety is paramount when it comes to bond investment and therefore return chasing must be avoided.

Happy Investing!